[debt_ratio_calculator]

How to Use the Debt-to-Income (DTI) Ratio Calculator and Why It Matters for Your Finances

Managing your finances effectively is crucial, and one of the most important metrics in understanding your financial health is your Debt-to-Income (DTI) Ratio. Whether you’re planning to take out a loan, mortgage, or simply trying to get a clearer picture of your financial situation, knowing how to calculate your DTI can make all the difference. Thankfully, we’ve made it super easy with our Debt-to-Income Ratio Calculator!

What Is the Debt-to-Income Ratio?

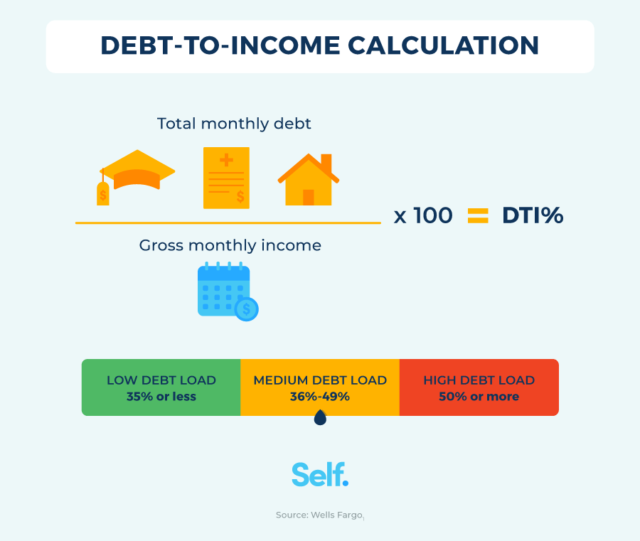

The Debt-to-Income Ratio (DTI) is a financial measure that compares your monthly debt payments to your gross monthly income. It shows what percentage of your income is going toward repaying debt each month. Lenders, including banks and credit institutions, often use this ratio to assess your ability to repay a loan. A lower DTI indicates that you have a good balance between debt and income, while a higher DTI suggests that a significant portion of your income is committed to debt.

How to Use Our Debt-to-Income Ratio Calculator

Our Debt-to-Income Ratio Calculator is simple to use and provides instant results. Here’s how you can calculate your DTI in just a few easy steps:

- Enter Your Monthly Income: In the first input field, type in your total monthly income. This includes your salary, any side business income, or other regular sources of income.

- Enter Your Monthly Debt: Next, input the total amount of money you pay each month toward debts such as credit card payments, loans, mortgage, or any other debt obligations.

- Click on “Calculate DTI”: Once you’ve entered your monthly income and debt, click the Calculate DTI button. The calculator will instantly compute your Debt-to-Income Ratio and display it as a percentage.

- Review the Results: The result will show you your Debt-to-Income Ratio, which helps you understand your current financial standing. A lower ratio is considered better, as it means you’re spending less of your income on debt.

Pros of Using the Debt-to-Income Ratio Calculator

- Simple & Easy to Use: Our calculator is user-friendly and quick, requiring only a few basic details to give you an instant result. No complicated forms or financial jargon here!

- Helps You Understand Your Financial Health: Knowing your DTI ratio gives you a clear understanding of your financial health. If you’re planning to apply for a loan or mortgage, this tool helps you figure out if you’re financially ready for that step.

- Improves Financial Planning: Regularly calculating your DTI can help you adjust your spending, reduce debt, and improve your savings. It’s a great tool for anyone looking to get a better grip on their finances.

- Essential for Loan & Mortgage Applications: If you’re thinking about applying for a loan or mortgage, most lenders will look at your DTI to assess whether you can afford the repayments. Having a healthy DTI ratio increases your chances of approval.

- Responsive & Mobile-Friendly: Whether you’re on your desktop, tablet, or mobile phone, our Debt-to-Income Ratio Calculator works seamlessly across all devices, giving you flexibility anytime, anywhere.

Cons of Using the Debt-to-Income Ratio Calculator

- Does Not Consider Other Financial Factors: While DTI is an important factor, it doesn’t account for your overall financial picture, such as savings, assets, or lifestyle costs. It’s just one piece of the puzzle.

- Does Not Include Future Debt: The calculator only accounts for your current monthly debt payments, not any anticipated future debt (like an upcoming loan or credit card balance). Be mindful of potential future changes.

- Limited for Complex Financial Situations: If you have complex financial arrangements, like multiple income sources or non-traditional debts, this calculator might not capture all the nuances of your financial situation.

Why Should You Calculate Your DTI?

Knowing your DTI ratio can help you in several ways:

- Loan Approvals: Lenders use your DTI to evaluate if you’re eligible for loans and how much you can afford to borrow.

- Debt Management: If your DTI is high, it’s an indicator that you may need to focus on paying down debt to improve your financial health.

- Financial Goals: If you’re working towards financial goals like buying a house, refinancing, or saving for the future, understanding your DTI helps you make more informed decisions.

Final Thoughts

Your Debt-to-Income Ratio is a crucial tool for assessing your financial health. By using our Debt-to-Income Ratio Calculator, you can gain valuable insights into your financial situation and make more informed decisions about your financial future.

Whether you’re preparing for a loan application, looking to reduce your debt, or simply want to understand your current financial status, this calculator is a must-have tool for anyone serious about managing their finances.

Try it now, and take control of your financial future today!

Call to Action (CTA):

Don’t forget to share this helpful calculator with friends and family who might benefit from it! Need further help or have questions? Leave a comment below or contact us for more personalized assistance!